Profitable

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A direct lender with a modern approach to reliability. We secure your data and support you in challenging conditions

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

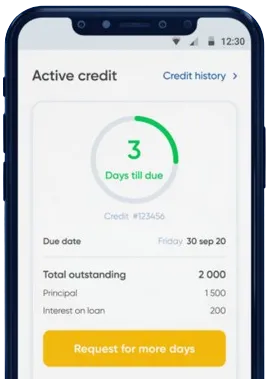

Use the app to send your request, simply fill in the form.

Stand by for our decision, usually delivered in just 15 minutes.

Secure your funds, generally processed in just one minute.

Use the app to send your request, simply fill in the form.

Download loan app

fast loan have become increasingly popular in Nigeria as a convenient and efficient way to access emergency funds. Whether you need money for urgent medical expenses, home renovations, or any unexpected financial situation, fast loan can provide you with the necessary financial support in a timely manner.

There are several benefits to taking out a fast loan in Nigeria. One of the main advantages is the speed at which you can access the funds. Unlike traditional bank loans that may take weeks to approve, fast loan can be approved within hours or even minutes, making them ideal for urgent situations.

Another benefit of fast loan is the minimal documentation required. Most fast loan providers in Nigeria have simplified the application process, making it quick and easy to apply for a loan online. This means you can avoid the hassle of lengthy paperwork and long approval processes.

Additionally, fast loan in Nigeria are available to individuals with varying credit scores. Whether you have a good credit history or a less-than-perfect credit score, you may still qualify for a fast loan. This offers greater flexibility and accessibility to those in need of financial assistance.

fast loan can be extremely useful in a variety of situations. From covering unexpected medical expenses to financing a last-minute travel opportunity, fast loan offer a flexible financial solution to meet your needs. Whether you are a salaried employee, a business owner, or a freelancer, fast loan can provide you with the financial support you need to address your immediate financial concerns.

Moreover, fast loan can also help you build or improve your credit score. By borrowing and repaying a fast loan on time, you demonstrate creditworthiness and responsibility to financial institutions, which can positively impact your credit profile in the long run.

Applying for a fast loan in Nigeria is a simple and straightforward process. You can typically apply for a loan online by filling out a short application form and providing basic personal information. Once your application is submitted, the loan provider will review your information and determine your eligibility for a loan.

Upon approval, the loan amount will be disbursed to your bank account within a short period of time, allowing you to access the funds quickly and conveniently.

Overall, fast loan in Nigeria offer a host of benefits and can be a useful financial tool for individuals in need of quick access to funds. Whether you are faced with an unexpected expense or simply need a little extra cash to tide you over until your next payday, fast loan can provide you with the financial support you need, when you need it most.

A fast loan in Nigeria is a type of short-term financial assistance that can be obtained quickly, usually within a few hours or days, to help individuals cover emergency expenses or unexpected financial needs.

Most lenders in Nigeria offer online application options for fast loan. You can visit their website, fill out the required forms, submit the necessary documents, and await approval.

Requirements for fast loan in Nigeria may vary from lender to lender, but common qualifications include being a Nigerian citizen or resident, having a regular source of income, and being of legal age (usually 18 years old).

The amount you can borrow with a fast loan in Nigeria depends on the lender and your financial situation. Generally, loan amounts range from ₦10,000 to ₦1,000,000.

fast loan in Nigeria usually have short repayment periods, ranging from a few weeks to a few months. Be sure to check with your lender for specific repayment terms.

Interest rates for fast loan in Nigeria can vary, but they are generally higher than traditional bank loans due to the quick and easy access to funds. Make sure to compare rates from different lenders before applying for a fast loan.